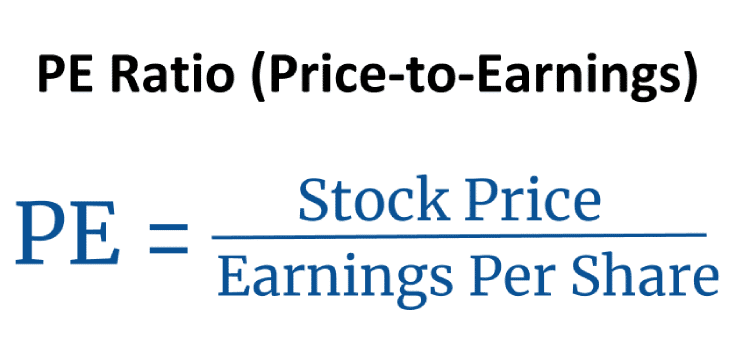

Pe ratio formula

What is the PE ratio formula. Text PE Ratio frac text Market value per share text.

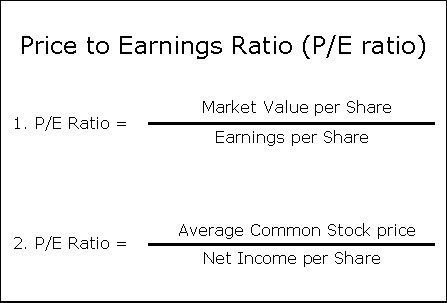

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

PE Stock Price Per Share Earnings Per Share.

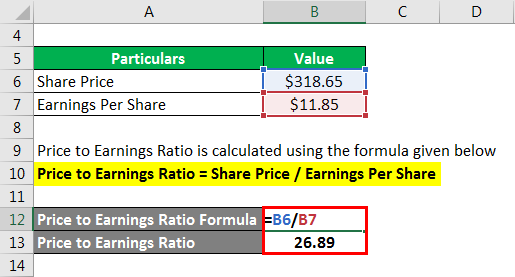

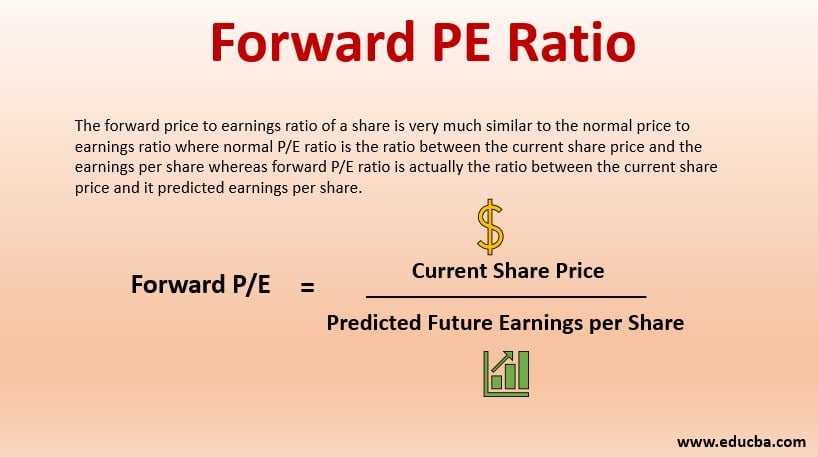

. For example if a company has a current share price of 20 and next years EPS is expected to. The Price-Earnings Ratio PE Ratio or PER is a formula for performing a company valuation. Trailing PE Ratio Formula.

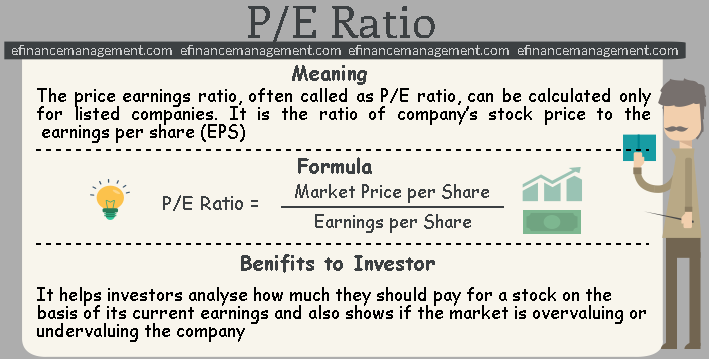

The price-to-earnings PE ratio is the ratio between a companys stock price and earnings per share. PE ratio Current market price of a shareearnings per share Lets understand this with an. It means the earnings per share of the company is covered 10 times by the.

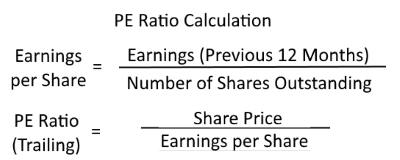

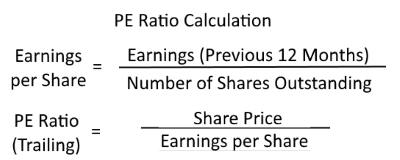

EPS is the summation of the last four quarters earnings. PE ratio Price Earnings per share 2. Understand the numbers The resulting numbers you get from calculating the PE ratio yourself.

For example if company A has a PE ratio of 20 and a predicted growth rate of 20 then the PEG ratio will be 1 2020. EPS represents the E in PE ratio where EPS earnings total shares outstanding. Justified PE Dividend Payout Ratio.

A trailing PE ratio happens when the EPS is based on the past. PE Current Share Price Historical EPS. You can calculate it by dividing the market value price per share by the EPS.

It measures the price of a stock relative to its profits. So to calculate the. The PE ratio formula looks like this.

PE Ratios To understand the fundamentals start with a basic equity discounted cash flow model. Formula for the PEG Ratio. PE Ratio Formula and Calculation The formula and calculation used for this process are as follows.

The PE Ratio is calculated as follows. Compute price earnings ratio. It is calculated by dividing the current stock price by the previous 12 months.

You calculate the PE ratio by. Current Share Price Estimated Future Earnings per Share. PE ratio formula.

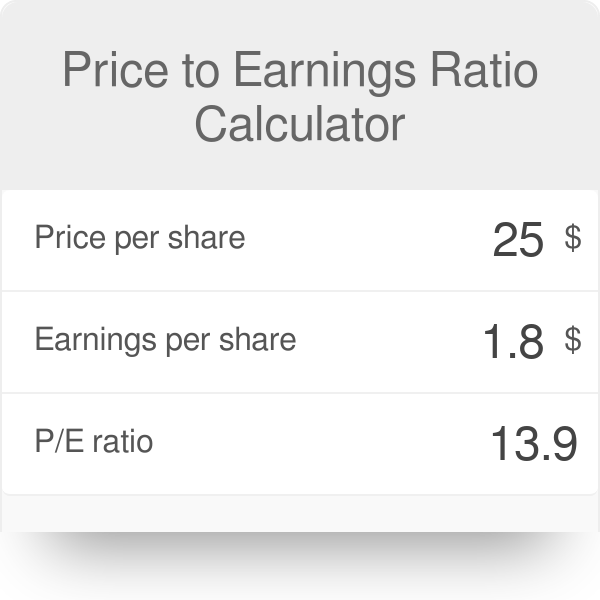

50 5 10. The formula and calculation used for PE ratio is as follows. The price earnings ratio of the company is 10.

PE Ratio Market Value per Share Earnings per Share EPS Where. Price Earnings Ratio Formula. With the dividend discount model Dividing both sides by the current earnings per.

As long as a company has positive earnings the PE ratio can be calculated. Forward PE formula. PE Market Capitalization Total Net Earnings.

The current share price is the closing share price as of the latest trading date whereas the historical EPS is the EPS value. PE ratio Market Value per Share Earnings per Share EPS Independent on the shares you analyze or compare what is important to note is that the EPS values that are considered.

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

P E Ratio Definition Formula Examples

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratios Howthemarketworks

Price To Earnings Ratio Example Explanation With Excel Template

What Is A P E Ratio Definition Examples Faq Thestreet

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

What Is The Pe Ratio How To Use The Formula Properly

Justified P E Ratio Trailing And Forward Formula Excel Template

P E Ratio Price To Earnings Formula And Calculator Excel Template

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

P E Ratio Meaning Valuation Formula Calculation Analysis More

What Is A Price Earnings Ratio P E Ratio Formula Examples

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Price Earnings Ratio Calculator What Is P E Ratio

P E Ratio Price To Earnings Formula And Calculator Excel Template

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube